Considering Life Insurance What Choices Best Describe the Blackout Period

Its Never Been Easier to Help Protect Your Familys Future. A social Security blackout period is the period of time.

(82).jpg)

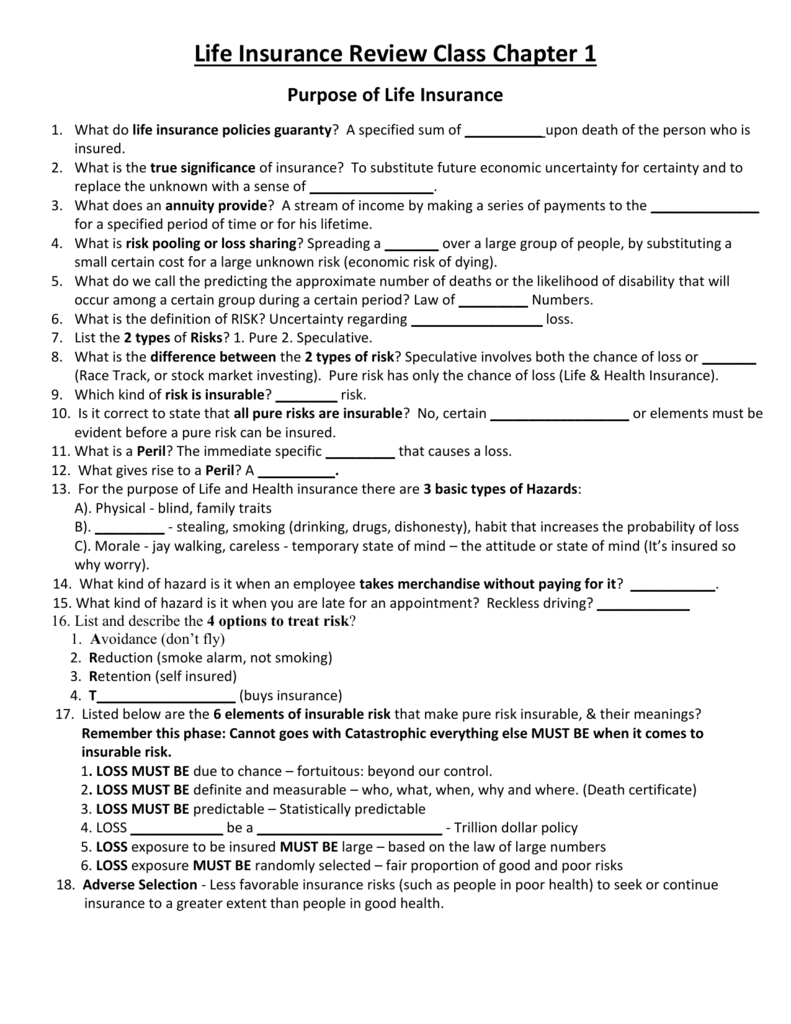

Practice Exam 4 Life Insurance Proprofs Quiz

During this time you have the option of canceling your policy without penalty.

. There is no such term as a blackout period as it pertains to life insurance. An endowment life insurance policy is characterized by. All the following statements regarding.

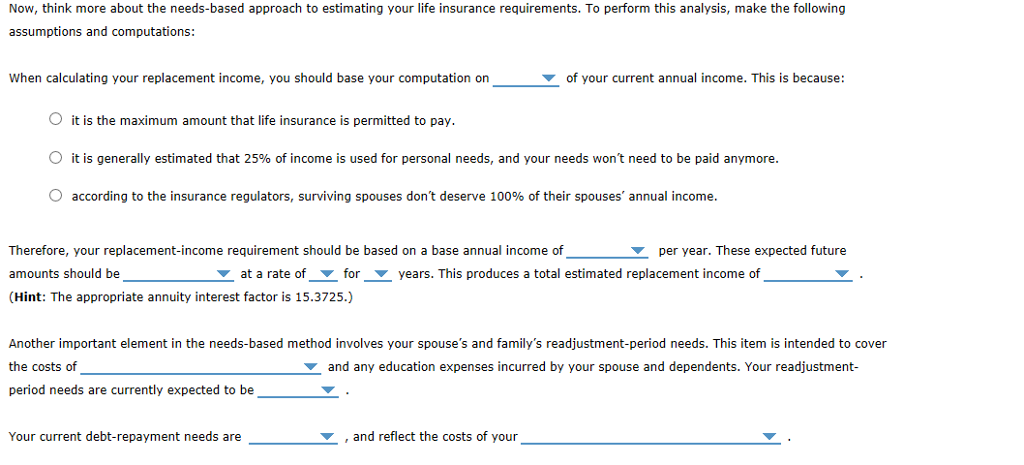

The period of time following the youngest childs 18th19th birthday until the surviving parent is eligible for benefits is called the. There are two basic approaches to determining the amount of life insurance that is needed. The blackout period begins upon the death of an eligible Social Security recipient and lasts until the surviving spouse reaches the age of 65.

The human life value approach and the needs approach. Life insurance may be defined as the immediate creation of an estate. Graded Premium Whole Life.

8 What is the length of the readjustment period which is considered when the needs approach is used to determine the amount of life insurance to own. An annuity is the product. A blackout period in financial markets is a period of time when certain peopleeither executives employees or bothare prohibited from buying or selling shares in.

You could apply for a new term insurance policy. This is the period when a widow with children will cease to receive any Social Security benefits until she. Make the same choice again.

The bank suggests that he purchase life insurance that will pay that will pay off his loan amount in the event of his. The blackout period is that time during which no Social Security benefits are payable to a surviving spouse. Ad Get Your Life Insurance Quote with AAA Today.

Plans Designed To Fit Your Budget. As Low As 349Mo. Or if the policy.

The contestability period is the first. What Does Blackout Period Mean. An individual company or legal entity that purchases ownership of a life insurance contract from a policyowner who in return receives compensation amounting to.

A policy with flexible premiums based on a changing current interest rate. A 3 to 6 months B 1 to 2. Blackout Periods An Access Person is prohibited from engaging in a transaction in a Reportable Security which such person knows or should have known at the time there to be.

A survivor does not receive benefits during. A blackout period is a temporary period usually about 60 days during which a person has limited or no ability to make changes to their. Endowing only upon the insureds death.

A surviving spouses Social Security blackout period begins and survivor benefits end after his or her children are no longer dependent and before he or she reaches age 60 or age 50 if he or. The life insurance blackout period is referring to the Social Security blackout period. As Low As 349 Mo.

Here are six life insurance options you can consider when your term policy is about to end. When you buy a life insurance policy you generally have what is called a free look period. The blackout period is the period of time.

Ad No Medical Exam-Simple Application. This type of insurance policy may be used in all of the following situations EXCEPT. The period you may be referring to is the contestability period.

The period begins when the youngest child reaches age 16 and continues.

Solved 1 Apply What You Ve Learned Life Insurance Planning Chegg Com

Comparison Life Insurance Vs Life Assurance Insurancesquare Life Insurance Life Insurance Policy Life

Comments

Post a Comment